Educate in the workplace

A successful business is driven by productive and motivated people.

More and more employers are seeing the tangible benefits of equipping their employees with a financial education. The simple reality is that employee debt and financial stress become a businesses’ problem because it results in a loss of productivity, turnover of experienced staff and negatively impacts the overall efficiency of your teams. The invariable effect is a loss of company profits.

- Staff are more motivated to achieve business objectives when they are also achieving their own goals.

- There are significant decreases seen in areas of absenteeism and presenteeism.

- There is a reduction in requests for staff loans.

- Managers spend less time dealing with distractions.

When employees are equipped to be good money managers they:

- Reduce or eliminate their debt and related financial stress

- Have better cash flow through prioritised spending

- Plan and achieve lifestyle goals

- Can protect themselves from unscrupulous creditors and collection agencies

- Improve their levels of financial security and independence

Most employees agree that January is ‘the longest month of the year’ due to receiving their pay too early in December. This invariably means staff begin the year with low morale instead of arriving back rested and full of energy.

Studies in the USA

show that changing employee’s financial behaviour is actually easier than changing their diet and exercise habits.

The result?

Decrease in stress and related health-care costs.

The Money School has extensive experience creating & implementing successful Employee Financial Education programs for a wide range of clients, including some major financial services companies in South Africa.

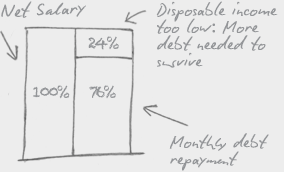

Among consumers with annual incomes of R300k - R500k, debt to disposable income was just over 100%. For those earning R500k - R750k, the level was 130%, and for those earning more than R750k, the level fell to just under 120%.

Source: Study conducted by the

University of SA’s Bureau of

Market Research in 2008.

TMS will deliver a benefit to your bottom line.

Learning to manage money effectively is a game changer.